Knight Frank’s Mark Topliff writes why the Sustainable Farming Incentive (SFI) is now worth considering and consultant Andrew Martin provides an example of how arable land can make the most of the scheme.

When the SFI was launched in 2022, it was generally met with a lukewarm reception by farmers and environmental organisations. English Basic Payment Scheme (BPS) payments are working towards their potential cessation by 2027, and most farmers are seeking other sources to fill or mitigate the drop in income. Defra has made changes to the SFI that has made it a more attractive option to explore and help fill the income shortfall.

Why is SFI 2023 worth engaging with?

So, there are several reasons why the 2023 offer is now worth considering.

- More flexibility – the pick and mix structure allow land managers to select the actions that may fit in with existing practice and rotation or are easy to adjust to and incorporate changes.

- Higher payment rates – since the start of SFI the payment rates have been criticised, but they have now been increased, and some rates made the same across land types and schemes.

- Tenant-friendly agreements – you don’t need the permission of your landlord to apply for an agreement if you’re a tenant farmer, and tenants can have an SFI agreement even if they are on a shorter, rolling tenancy contract.

- Stacking of options – it’s possible to combine with other schemes’ options such as Countryside Stewardship and Environmental Stewardship.

- Management payment – payment of £20 per hectare, up to 50ha in total, for your time managing the scheme.

- Simple application – A simple online application process and a rolling application window.

- Paid quarterly – more frequent payments which help with cashflows.

- You don’t lose out – Defra has shown that previous applicants that joined prior to any changes will also benefit from the improved offer.

Defra has also promised further options to be rolled out in 2024 possibly including actions involving agroforestry and water body buffering.

Using the SFI on arable farms

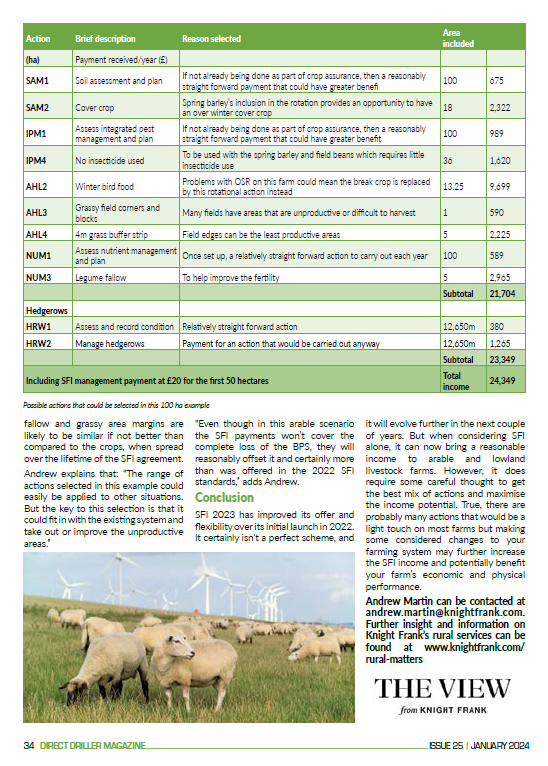

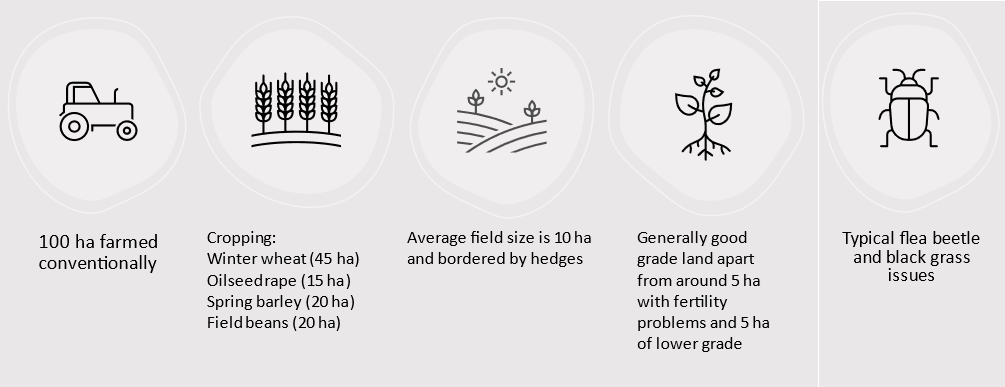

But what does this mean for an arable farm? Andrew Martin of Knight Frank’s Agri-consultancy team explores how the SFI actions can be combined to maximise payments, using an example 100 ha block of arable land.

Arable land example

Possible actions that could be selected in this 100 ha example

| Action | Brief description | Reason selected | Area included (ha) | Payment received/year (£) |

| SAM1 | Soil assessment and plan | If not already being done as part of crop assurance, then a reasonably straight forward payment that could have greater benefit | 100 | 675 |

| SAM2 | Cover crop | Spring barley’s inclusion in the rotation provides an opportunity to have an over winter cover crop | 18 | 2,322 |

| IPM1 | Assess integrated pest management and plan | If not already being done as part of crop assurance, then a reasonably straight forward payment that could have greater benefit | 100 | 989 |

| IPM4 | No insecticide used | To be used with the spring barley and field beans which requires little insecticide use | 36 | 1,620 |

| AHL2 | Winter bird food | Problems with OSR on this farm could mean the break crop is replaced by this rotational action instead | 13.25 | 9,699 |

| AHL3 | Grassy field corners and blocks | Many fields have areas that are unproductive or difficult to harvest | 1 | 590 |

| AHL4 | 4m grass buffer strip | Field edges can be the least productive areas | 5 | 2,225 |

| NUM1 | Assess nutrient management and plan | Once set up, a relatively straight forward action to carry out each year | 100 | 589 |

| NUM3 | Legume fallow | To help improve the fertility | 5 | 2,965 |

| Subtotal | 21,704 | |||

| Hedgerows | ||||

| HRW1 | Assess and record condition | Relatively straight forward action | 12,650m | 380 |

| HRW2 | Manage hedgerows | Payment for an action that would be carried out anyway | 12,650m | 1,265 |

| Subtotal | 23,349 | |||

| Including SFI management payment at £20 for the first 50 hectares | Total income | 24,349 |

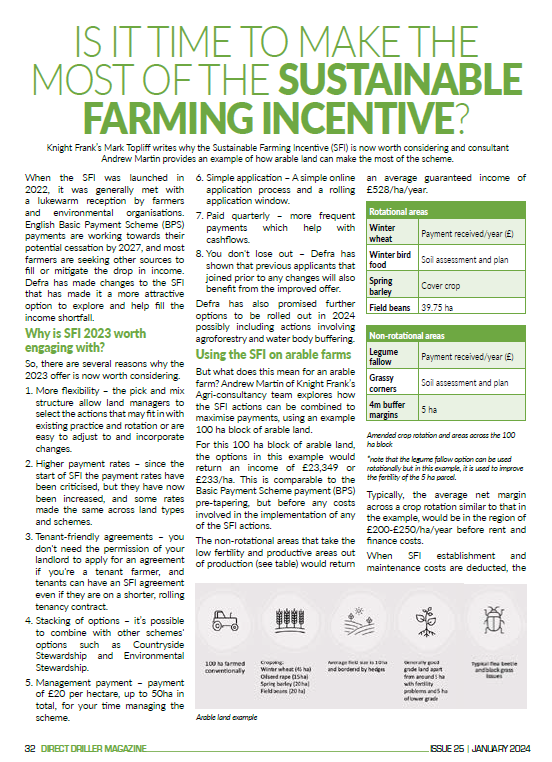

For this 100 ha block of arable land, the options in this example would return an income of £23,349 or £233/ha. This is comparable to the Basic Payment Scheme payment (BPS) pre-tapering, but before any costs involved in the implementation of any of the SFI actions.

The non-rotational areas that take the low fertility and productive areas out of production (see table below) would return an average guaranteed income of £528/ha/year.

Amended crop rotation and areas across the 100 ha block

| Rotational areas | Winter wheat Winter bird food Spring barley Field beans | 39.75 ha 13.25 ha 18 ha 18 ha |

| Non rotational areas | Legume fallow Grassy corners 4m buffer margins | 5 ha 1 ha 5 ha |

*note that the legume fallow option can be used rotationally but in this example, it is used to improve the fertility of the 5 ha parcel.

Typically, the average net margin across a crop rotation similar to that in the example, would be in the region of £200-£250/ha/year before rent and finance costs.

When SFI establishment and maintenance costs are deducted, the fallow and grassy area margins are likely to be similar if not better than compared to the crops, when spread over the lifetime of the SFI agreement.

Andrew explains that: “The range of actions selected in this example could easily be applied to other situations. But the key to this selection is that it could fit in with the existing system and take out or improve the unproductive areas.”

“Even though in this arable scenario the SFI payments won’t cover the complete loss of the BPS, they will reasonably offset it and certainly more than was offered in the 2022 SFI standards,” adds Andrew.

Conclusion

SFI 2023 has improved its offer and flexibility over its initial launch in 2022. It certainly isn’t a perfect scheme, and it will evolve further in the next couple of years. But when considering SFI alone, it can now bring a reasonable income to arable and lowland livestock farms. However, it does require some careful thought to get the best mix of actions and maximise the income potential. True, there are probably many actions that would be a light touch on most farms but making some considered changes to your farming system may further increase the SFI income and potentially benefit your farm’s economic and physical performance.

Andrew Martin can be contacted at andrew.martin@knightfrank.com. Further insight and information on Knight Frank’s rural services can be found at www.knightfrank.com/rural-matters