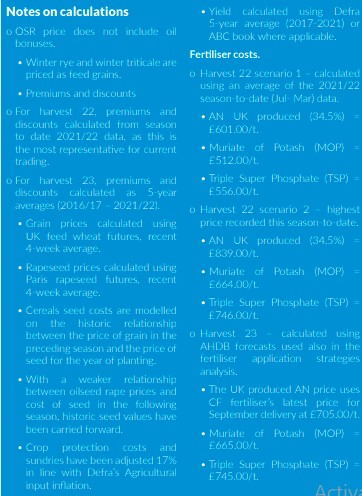

Written by Megan Hesketh – Senior Analyst – Arable

We are fast approaching harvest 22 and looking now to harvest 23 for cropping decisions, but the cost and margin picture looks very different to this time last year. UK feed wheat new crop futures (Nov-22) closed yesterday at £340.10/t. This is almost double the price from this time last year, where new crop futures (Nov-21) closed at £178.75/t (18 May 2021). A tight supply and demand balance for grains across the board, intensified by the outbreak of war between Russia and Ukraine, has driven values to record highs in recent months.

Though input costs have been rising too. This season-to-date (Jul-Apr), UK produced AN (34.5% N) prices have averaged £601.00/t, up 138% (+£349.00/t) from the average over the 2020/21 season.

Today, I explore how this changing picture has impacted on gross margins. The aim of these figures is to not directly indicate how much profit can be made by each crop, because variable costs will differ by farm. It is more to understand a difference in profitability by year, and to support decision making for harvest 23 cropping. These figures may also give an indication of what the UK planted area may look like too.

Harvest 22 – costs high but prices higher…

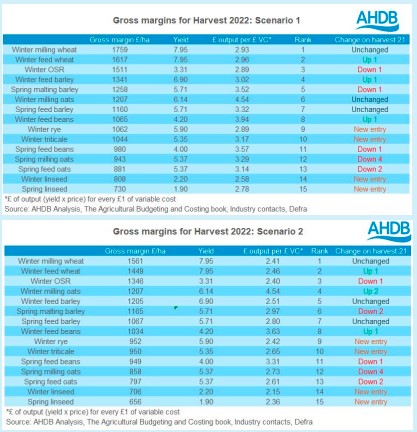

Using two scenarios, profitability between crops can be assessed for harvest 22. For many businesses, the story will rely on price paid for fertiliser and this impact on variable cost for harvest 22. The first scenario takes an average season-to-date for UK produced AN 34%, Muriate of Potash and Triple Super Phosphate. The second scenario takes the top recorded prices this season for these three fertilisers, to compare profitability. Perhaps to no surprise with strong global wheat values supporting UK feed wheat futures, milling wheat and feed wheat are top performers in both scenarios. Though the difference in the price paid for fertiliser makes a large difference in gross margin.

For the milling wheat premium for harvest 22, this uses an average for the 2021/22 season to date. This season’s average has been higher on the year due to the current tight supply and concerns around milling wheat availability. As such, milling wheat gross margins look attractive for harvest 22 especially in scenario 1. Oilseed rape follows closely behind, considering high prices supported from inelastic demand for rapeseed and rapeseed oil. However, new-crop (Nov-22) prices are lagging previous May-21 highs, as supply is expected to improve globally next season. However, crush demand is set to be firm also, which could keep balances tight in the first half of the marketing year.

Linseed, however, is understood now to be trading separately to oilseed rape. As a result, this crop may not have benefitted to the same extent from rapeseed’s price highs.

Harvest 23 – prices lower than harvest 22, but costs to

remain high?

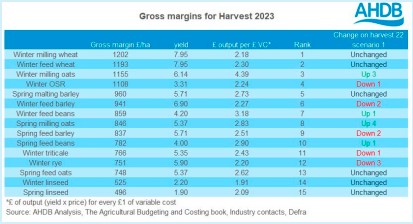

Looking to harvest 23, costs look to remain high. Nov-23 UK feed wheat futures prices too look to be firm. Yesterday, the contract closed at £280.20/t. Though is this enough to offset high prices?

Using AHDB forecasts for potassium and phosphate costs, and using CF fertiliser’s latest price for September delivery, margins look to be squeezed compared to harvest 22.

Even if there was a timely end to the war in Ukraine, destruction to Ukraine’s export infrastructure will cause longer term challenges. This adds to the global tightness outlook for the medium term, still further supporting 2023 wheat prices. As such, milling wheat and feed wheat remain top performers. However, the difference between the two looks narrower than harvest 22. For harvest 23, we have used a 5-year average premium to calculate the milling wheat price. This is despite the past two years seeing firmer premiums. Should the milling wheat balance remain tight next season, we could see this premium increase, especially as harvest 23 approaches.

Looking to other crops, milling oats performed higher than winter rapeseed for harvest 23. We can explain this through reduced applications of fertiliser filtering into reduced variable costs. Winter rapeseed margins look to remain favourable for harvest 23. Will the price incentive be enough for farmers to consider growing more? There are still the same issues surrounding cabbage stem flea beetle (CSFB) and impact on yield. But this year’s crop conditions have not noted significant damage. However, in regard to break crops, feed beans and winter triticale look to deliver a higher output per £1 spent on variable cost. The pulses market can be variable at times, but crops require lower inputs and benefit fields though nitrogen fixing. Something to consider in another high-cost year.

Conclusion

Perhaps unsurprisingly, when you purchased your fertiliser and how much you paid for it will be a big factor in your gross margin picture for harvest 22.

Looking forward to harvest 23, UK feed wheat prices look firm for Nov-23, but rising input costs will be a challenge. Purchasing your fertiliser will be something to think about, considering prices for AN are now available for September delivery. However, cash flow will remain a key concern to many, given the increase in input prices.

Also, a price output per £1 spent on variable cost will be something to consider, given the rising cost picture. For help assessing how your farm performance currently, Farmbench is a useful tool available from the AHDB.