The latest Cereals Agri-Outlook takes stock of the current situation and looks forward to what we might expect in the coming months, for supply availability, trade and demand. The volumes below are estimates at the time of writing.

Production

Wheat supply on the global market remains constrained, from the lasting impact of extreme weather trimming production in major exporters last season, exacerbated by the war in Ukraine. However, ample competitive Russian supplies continue to pick up global demand.

Despite global wheat prices coming back down from the highs seen back in May 2022, post the outbreak of the war in Ukraine, prices remain historically elevated. A tight global maize supply and demand too is providing a strong floor for overall grain prices, with concerns surrounding a drought impacted Argentinian crop despite a large Brazilian crop due. Demand now remains a key watchpoint for the direction of global grain prices, considering economic performance and recessionary behaviour concerns across major economies. Price direction will be increasingly influenced by new-crop weather as we head through the second half of the season.

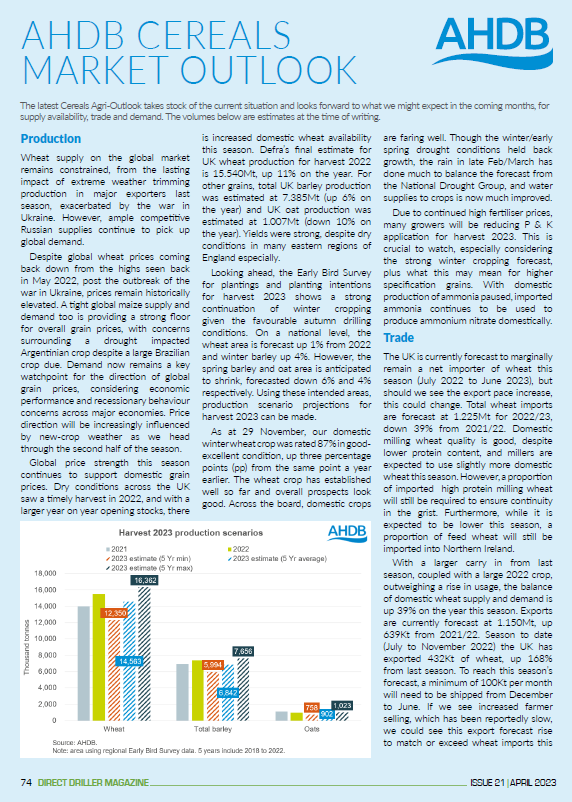

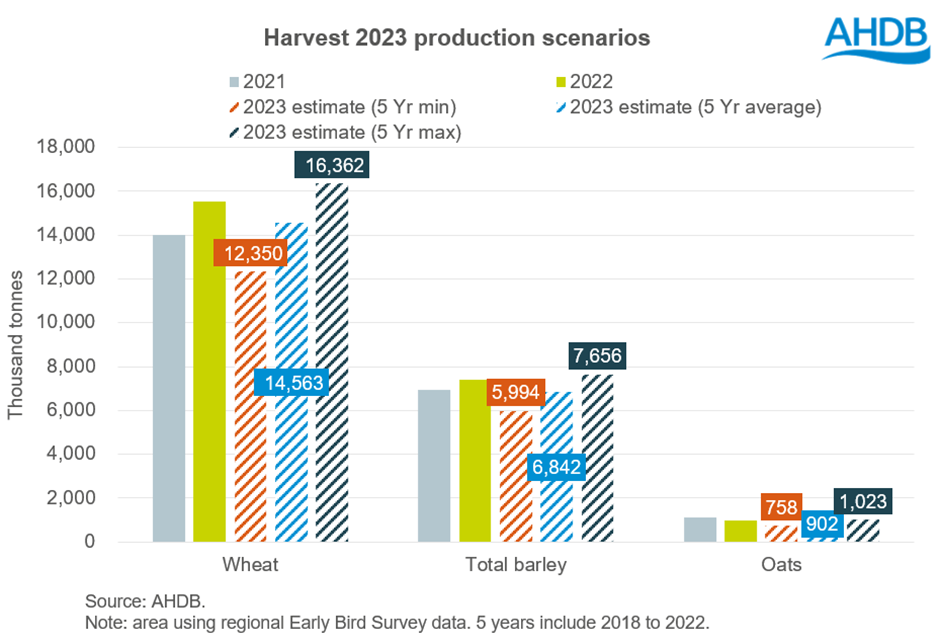

Global price strength this season continues to support domestic grain prices. Dry conditions across the UK saw a timely harvest in 2022, and with a larger year on year opening stocks, there is increased domestic wheat availability this season. Defra’s final estimate for UK wheat production for harvest 2022 is 15.540Mt, up 11% on the year. For other grains, total UK barley production was estimated at 7.385Mt (up 6% on the year) and UK oat production was estimated at 1.007Mt (down 10% on the year). Yields were strong, despite dry conditions in many eastern regions of England especially.

Looking ahead, the Early Bird Survey for plantings and planting intentions for harvest 2023 shows a strong continuation of winter cropping given the favourable autumn drilling conditions. On a national level, the wheat area is forecast up 1% from 2022 and winter barley up 4%. However, the spring barley and oat area is anticipated to shrink, forecasted down 6% and 4% respectively. Using these intended areas, production scenario projections for harvest 2023 can be made.

As at 29 November, our domestic winter wheat crop was rated 87% in good-excellent condition, up three percentage points (pp) from the same point a year earlier. The wheat crop has established well so far and overall prospects look good. Across the board, domestic crops are faring well. Though the winter/early spring drought conditions held back growth, the rain in late Feb/March has done much to balance the forecast from the National Drought Group, and water supplies to crops is now much improved.

Due to continued high fertiliser prices, many growers will be reducing P & K application for harvest 2023. This is crucial to watch, especially considering the strong winter cropping forecast, plus what this may mean for higher specification grains. With domestic production of ammonia paused, imported ammonia continues to be used to produce ammonium nitrate domestically.

Trade

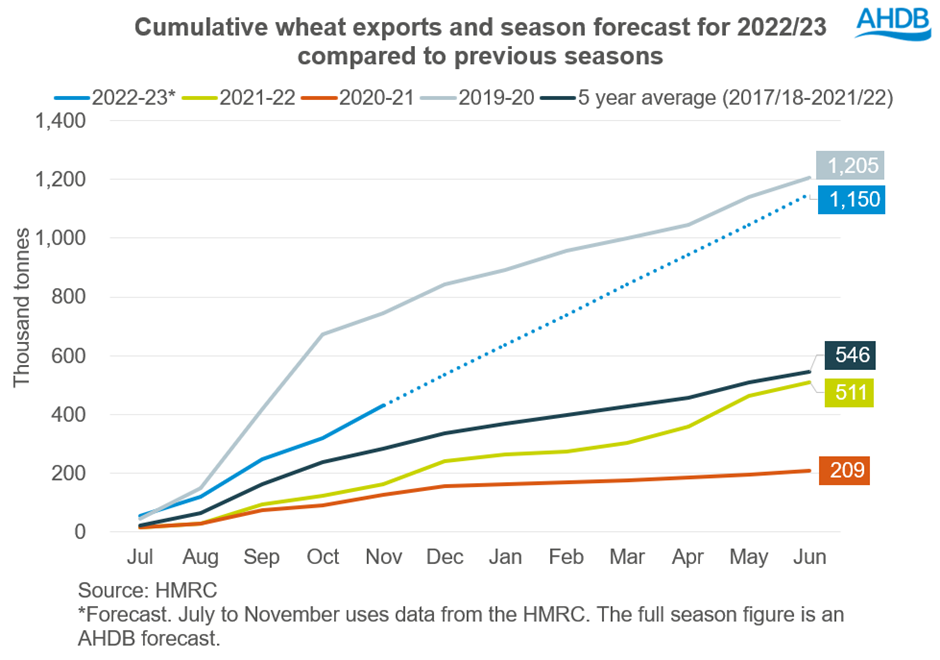

The UK is currently forecast to marginally remain a net importer of wheat this season (July 2022 to June 2023), but should we see the export pace increase, this could change. Total wheat imports are forecast at 1.225Mt for 2022/23, down 39% from 2021/22. Domestic milling wheat quality is good, despite lower protein content, and millers are expected to use slightly more domestic wheat this season. However, a proportion of imported high protein milling wheat will still be required to ensure continuity in the grist. Furthermore, while it is expected to be lower this season, a proportion of feed wheat will still be imported into Northern Ireland.

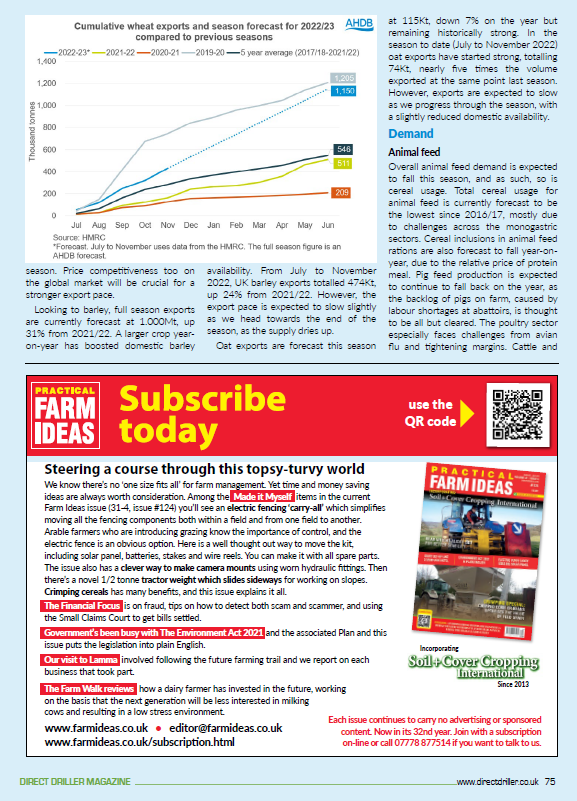

With a larger carry in from last season, coupled with a large 2022 crop, outweighing a rise in usage, the balance of domestic wheat supply and demand is up 39% on the year this season. Exports are currently forecast at 1.150Mt, up 639Kt from 2021/22. Season to date (July to November 2022) the UK has exported 432Kt of wheat, up 168% from last season. To reach this season’s forecast, a minimum of 100Kt per month will need to be shipped from December to June. If we see increased farmer selling, which has been reportedly slow, we could see this export forecast rise to match or exceed wheat imports this season. Price competitiveness too on the global market will be crucial for a stronger export pace.

Looking to barley, full season exports are currently forecast at 1.000Mt, up 31% from 2021/22. A larger crop year-on-year has boosted domestic barley availability. From July to November 2022, UK barley exports totalled 474Kt, up 24% from 2021/22. However, the export pace is expected to slow slightly as we head towards the end of the season, as the supply dries up.

Oat exports are forecast this season at 115Kt, down 7% on the year but remaining historically strong. In the season to date (July to November 2022) oat exports have started strong, totalling 74Kt, nearly five times the volume exported at the same point last season. However, exports are expected to slow as we progress through the season, with a slightly reduced domestic availability.

Demand

Animal feed

Overall animal feed demand is expected to fall this season, and as such, so is cereal usage. Total cereal usage for animal feed is currently forecast to be the lowest since 2016/17, mostly due to challenges across the monogastric sectors. Cereal inclusions in animal feed rations are also forecast to fall year-on-year, due to the relative price of protein meal. Pig feed production is expected to continue to fall back on the year, as the backlog of pigs on farm, caused by labour shortages at abattoirs, is thought to be all but cleared. The poultry sector especially faces challenges from avian flu and tightening margins. Cattle and sheep feed production is expected to remain slow this season. However, with the hot/dry conditions over the summer, some regions have poorer forage quality/availability which has boosted some feed requirements. The cost-of-living crisis remains a key watchpoint across all livestock sectors.

As a proportion of cereal inclusions, wheat remains a key feature, with large availability on the domestic market and a lessening price in recent months. The discount of spot UK average ex-farm feed barley to feed wheat sat just below £20.00/t as at 02 February. However, in the previous week the discount had reached below £7.00/t (as at 26 January 2023). Despite strong maize imports at the start of this season, looking forward, the large domestic wheat supply and relative price of maize is likely to cap maize inclusions in rations.

Milling

The quality of this season’s domestic milling wheat crop has been described as functional for millers. The results of the 2022 AHDB Cereal Quality Survey reflect strong specific weights and Hagberg Falling Numbers, but below average protein content. Despite lower average protein content, flour millers are expected to use slightly more home-grown wheat this season, considering the relative price to import. However, to ensure continuity in the grist, the UK will still need to import a proportion of high protein milling wheat.

This season, flour production is expected to remain relatively stable, though wheat usage by millers is forecast to decline slightly due to higher extraction rates from larger specific weights. The impact of the cost-of-living crisis on flour demand as well as some premium and alternative products, remains something to watch.

Human and industrial usage for oats is forecast up 2% this season from last, though the demand outlook has slowed since forecasts earlier in the season. Additional oat milling capacity is expected to come online next season. While it is not expected to impact 2022/23 demand, it is a key watchpoint going forward into next season.

Biofuels

Usage of home-grown wheat in bioethanol production remains a key watchpoint this season. Following the introduction of E10 by the UK government in September 2021, Vivergo reopened, meaning both UK bioethanol plants are operational. It is assumed both plants will remain in operation for the whole of 2022/23. However, they are not expected to be running at full capacity, in part due to longer maintenance periods.

Considering the relative price of maize currently, wheat is pricing more favourably for bioethanol usage. However, maize is not expected to drop out of inclusions altogether.

With high input costs for bioethanol production and significantly lower bioethanol prices, the outlook for bioethanol cereal usage has diminished significantly from forecasts earlier in the season and remains a key domestic demand watchpoint.

Brewers, Maltsters and Distillers (BMD)

Cereal usage from the BMD sector is forecast strong this season, across the board. Human and industrial usage for barley is forecast as the highest this century, considering strong demand seen so far this season and increased capacity in Scotland. Wheat usage too is expected to be strong for distilling and starch production, with increased capacity.

The cost-of-living crisis remains a key watchpoint for the industry, considering 4.5% of licensed premises open at the end of 2021 were closed by the end of 2022 and the impact on higher costs on smaller, independent BMD operations.

What could the outlook mean for GB prices?

With the UK having a heavier balance of cereals this season and a subsequent larger exportable surplus, UK prices are tracking European and global market movements closely and will likely continue to do so. Large supplies of Russian wheat are currently weighing down on markets. However, escalations to the war in Ukraine over recent weeks and strong EU wheat export demand has led to some support.

Over the next couple of months, the war in Ukraine will continue to add volatility to markets, especially as we near the expiry of the already extended export corridor deal on 21 March. Looking further ahead and US crop conditions will come to the forefront, as any crop damage caused by the extreme cold/dry conditions is assessed.

While the developments in Ukraine, strong EU exports and potential US crop damage could all add support to markets over coming months, it is unlikely prices will rise back up to levels we saw last May (unless another major global incident occurs), as a surplus of Russian supply will continue to limit gains somewhat.

Cereals consumption trends

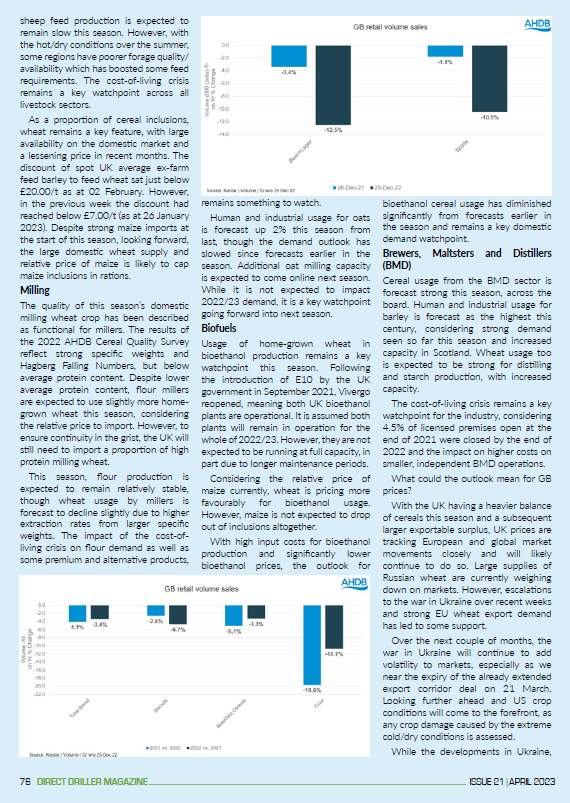

The gap between spend and volume sales has widened as inflation continues to impact the market and consumers change their shopping habits.

In-home consumption occasions are down 2.3 percentage points year on year but remain above pre-pandemic levels (Kantar Usage). As inflation has hit the market it has started to counter the trend of people returning to eating out of home post-, and we see more consumers favour in-home consumption. With this, there are greater opportunities for retail sales.

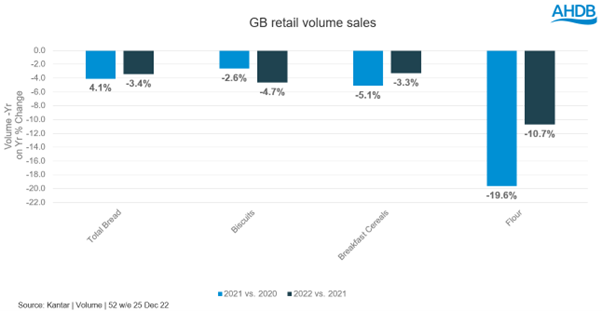

We are simplifying our meals more which is likely a result of a need for cheaper meal options. The simplification trend is evident at lunch, where more consumers are having lunch featuring sandwiches, up two percentage points vs 2021 (Kantar Usage, 8 w/e 02 October 2022). This provides good opportunity for bread, which currently sees volumes down 3.4% year-on-year because of people buying less often and less volume per trip (Kantar, 52 w/e December 2022).

Biscuits has seen a volume decline of 4.7% year on year, a result of shoppers buying less volume per trip (Kantar, 52 w/e 25 December 2022). Snacking occasions are down versus 2021 and we also see a reduction in the proportion of treat-orientated snacks (Kantar Usage). Given that 75% of people think that sweet biscuits are an affordable treat, communicating value for money will work in its favour.

Breakfast cereal volumes are down 3.3% year on year with the decline driven by shoppers buying into the category less often (Kantar, 52 w/e 25 December 2022). We have seen a move away from hot breakfasts recently which could benefit breakfast cereals alongside the need for simplification and convenience (Kantar Usage).

Flour has seen the steepest declines year on year, with volumes down 10.7%, with the decline driven by shoppers buying into the category less often (Kantar, 52 w/e 25 December 2022). As consumers stay at home more to manage spend, this could help boost baking occasions as an affordable leisure activity.

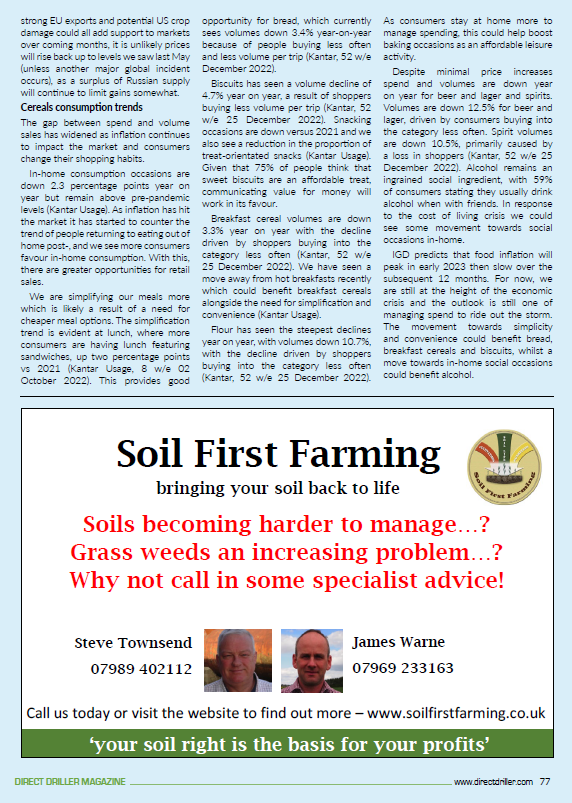

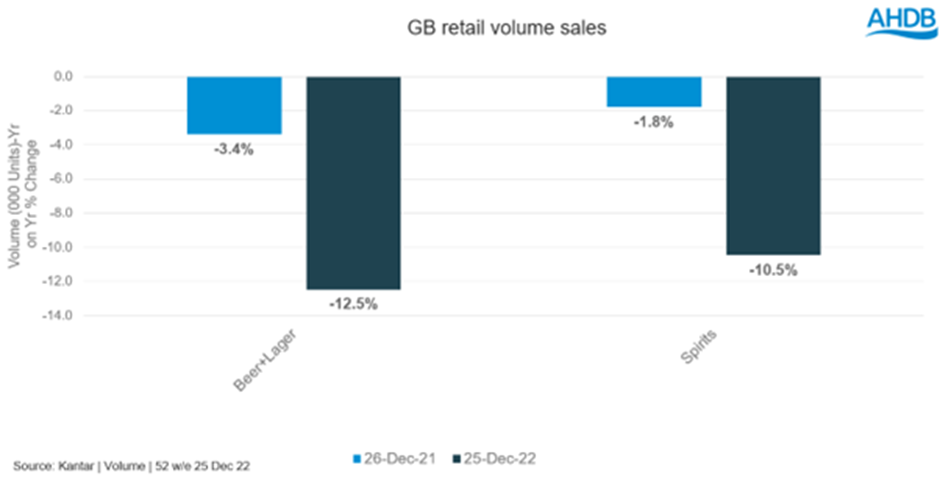

Despite minimal price increases spend and volumes are down year on year for beer and lager and spirits. Volumes are down 12.5% for beer and lager, driven by consumers buying into the category less often. Spirit volumes are down 10.5%, primarily caused by a loss in shoppers (Kantar, 52 w/e 25 December 2022). Alcohol remains an ingrained social ingredient, with 59% of consumers stating they usually drink alcohol when with friends. In response to the cost of living crisis we could see some movement towards social occasions in-home.

IGD predicts that food inflation will peak in early 2023 then slow over the subsequent 12 months. For now, we are still at the height of the economic crisis and the outlook is still one of managing spend to ride out the storm. The movement towards simplicity and convenience could benefit bread, breakfast cereals and biscuits, whilst a move towards in-home social occasions could benefit alcohol.